Home

Search

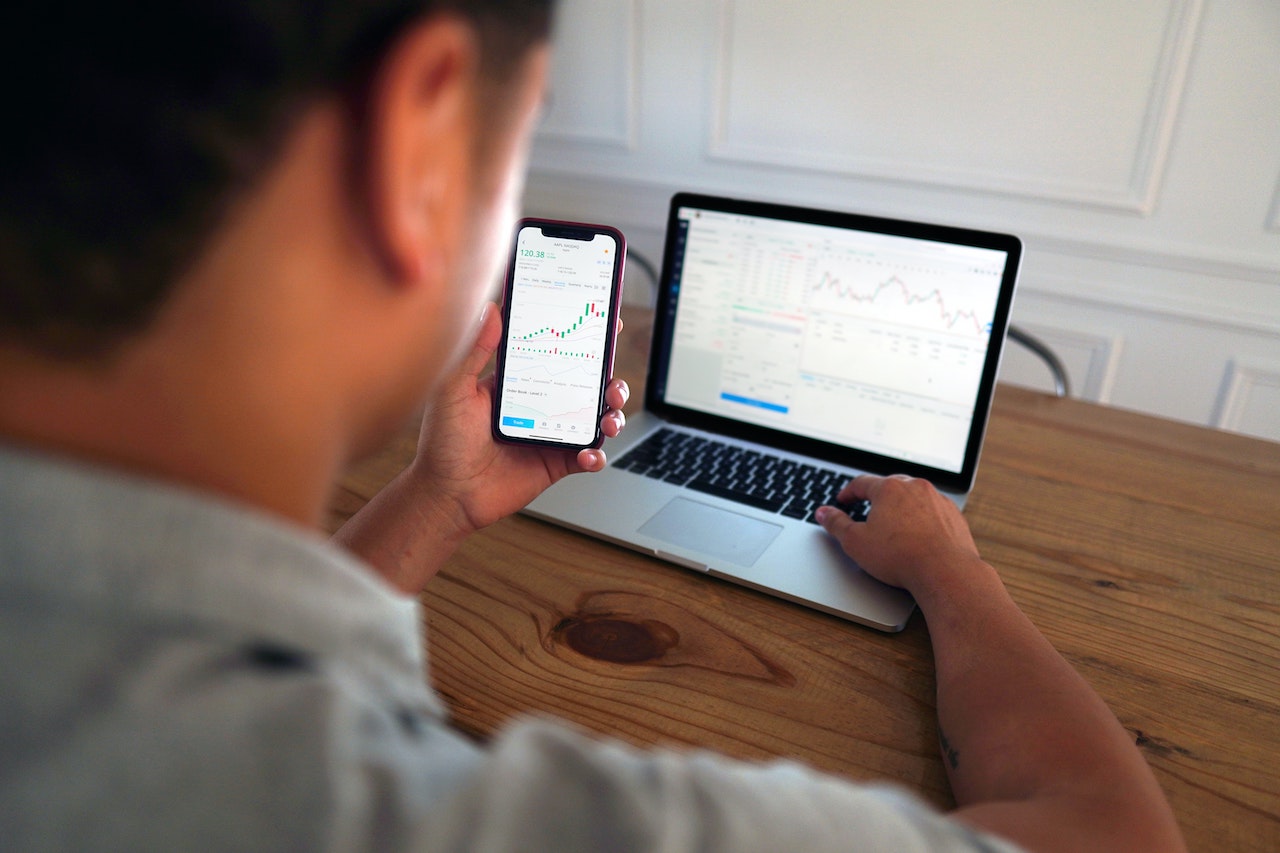

Stock Market - search results

If you're not happy with the results, please do another search